In many countries, especially how to compute 13th month pay is a legal right and a much-awaited year-end bonus. But most employees often ask: “How is it calculated?” Whether you’re a salaried employee or hourly worker, understanding how to compute your 13th month pay helps you avoid confusion and ensures you’re paid fairly.

In this detailed guide, we will explain everything—from the basic formula to real-life examples. Let’s break it down simply.

✅ What Is 13th Month Pay?

13th month pay is a mandatory benefit paid to employees at the end of the year. It’s usually equivalent to 1/12th of the employee’s total basic salary earned within a calendar year.

🏛 Legal Basis:

In the Philippines, it’s required under Presidential Decree No. 851, making it compulsory for all rank-and-file employees.

💼 Who Is Eligible for 13th Month Pay?

Not everyone may qualify. Here’s who is generally entitled to this benefit:

- All rank-and-file employees

- Employees who have worked for at least 1 month in the calendar year

- Both full-time and part-time workers (in most cases)

- Probationary employees

- Contractual employees (if under company payroll)

Note: Managers and freelancers are not automatically eligible unless stated in the contract.

❌ Who Is Not Covered?

There are some exceptions:

- Government employees (unless local policy states otherwise)

- Employees already receiving equivalent bonuses

- Workers paid purely on commission or boundary system (e.g., some delivery drivers or jeepney drivers)

📌 When Is 13th Month Pay Given?

As per law, the 13th month pay should be given on or before December 24 of each year. Some companies release it in two parts—one in May or June, and the remaining in December.

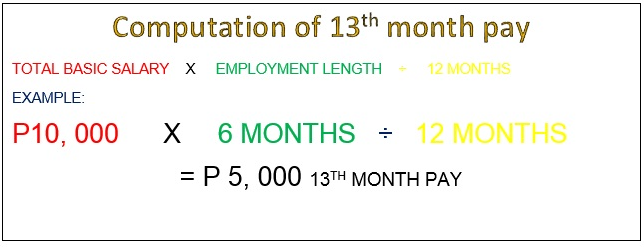

🧮 How to Compute 13th Month Pay – The Simple Formula

The general formula is:

sqlCopyEdit13th Month Pay = (Total Basic Salary Earned During the Year) ÷ 12

Only basic salary is included. Other forms of income like:

- Overtime pay

- Holiday pay

- Night shift differential

- Allowances

are excluded.

👨💼 Example for Salaried Employee

Let’s say Juan is a regular employee earning ₱20,000 per month. He worked from January to December with no absences or deductions.

➤ Computation:

javaCopyEditTotal Basic Salary = ₱20,000 × 12 = ₱240,000

13th Month Pay = ₱240,000 ÷ 12 = ₱20,000

So, Juan will receive ₱20,000 as his 13th month pay.

🧑🔧 Example for Hourly Worker

Anna is an hourly-paid worker earning ₱150 per hour. She works 8 hours/day, 22 days/month, from January to October only.

➤ Step-by-step:

- Monthly Basic Salary:

bashCopyEdit₱150 × 8 × 22 = ₱26,400/month

- Total Basic Salary (Jan–Oct):

CopyEdit₱26,400 × 10 = ₱264,000

- 13th Month Pay:

CopyEdit₱264,000 ÷ 12 = ₱22,000

So, Anna will receive ₱22,000, even though she only worked for 10 months.

📅 If You Didn’t Work the Whole Year?

No problem! You still get a pro-rated 13th month pay based on the number of months you worked.

➤ Example:

Ahmed joined a company in July with a salary of ₱18,000/month.

CopyEdit₱18,000 × 6 = ₱108,000

₱108,000 ÷ 12 = ₱9,000

Ahmed will get ₱9,000 as his 13th month pay.

💵 What’s Not Included in the Computation?

To avoid confusion, these are NOT part of the calculation:

- Overtime pay

- Commissions

- Meal/transportation allowances

- 14th month pay or bonuses

- Incentives or performance-based pay

Only your basic salary is used.

👩💻 Online Tools: 13th Month Pay Calculator

Don’t want to compute manually? You can use these free tools:

Simply enter your monthly salary and months worked.

❓ Frequently Asked Questions

1. Is 13th month pay taxable?

Yes, if your 13th month pay exceeds ₱90,000 (as of 2025), the amount in excess is taxable.

2. What if I resigned mid-year?

You’re still entitled to pro-rated 13th month pay. Just calculate based on months worked.

3. Can my employer delay the 13th month pay?

No. Employers are legally required to pay it on or before December 24.

4. Is 13th month pay the same as a Christmas bonus?

No. Christmas bonus is discretionary, while 13th month pay is mandatory under law.

5. Are maternity leaves included in the computation?

No. Only actual worked months are included. Maternity leave days are not part of basic salary for this computation.

6. Do part-time workers get 13th month pay?

Yes—if they are company employees, even part-time workers are entitled to a pro-rated 13th month pay.

7. What happens if I had salary deductions due to absences?

Those will affect your total basic salary, which means a lower 13th month pay.

🚨 Employer Penalty for Non-Compliance

Employers who fail to pay 13th month pay can face:

- Administrative fines

- Legal complaints

- Labor court action

Employees can file complaints at the Department of Labor and Employment (DOLE).

📘 Summary Table: Quick Overview

| Employee Type | Monthly Salary | Months Worked | 13th Month Pay |

|---|---|---|---|

| Salaried (Full Year) | ₱20,000 | 12 | ₱20,000 |

| Hourly (10 months) | ₱26,400 | 10 | ₱22,000 |

| Mid-Year Joiner | ₱18,000 | 6 | ₱9,000 |

✅ Final Thoughts: Know Your Rights and Your Worth

Understanding how to compute 13th month pay is essential for both employees and employers. It’s not just a bonus—it’s a right under labor law. Knowing how it’s calculated empowers you to ask questions, demand transparency, and ensure fairness.

Whether you are a full-time staffer or an hourly worker, don’t leave your money to guesswork. Use this guide, apply the formulas, or use online calculators—and always double-check your payslips.

🔚 Conclusion:

Your 13th month pay isn’t just a year-end treat—it’s your legal entitlement. With this guide, you now know exactly how to compute 13th month pay based on your work type and months of service. Stay informed, be proactive, and make sure you’re receiving what you’ve rightfully earned.